Call Today For a Free Demo: 303-309-1218

Email: info@smarterpos.net

The Best POS System Sales, Installation & Support

Welcome to Smart POS Colorado

Serving the hospitality industry for over 20 years, we are your local one stop shop for all restaurant, bar, quick service and retail point-of-sale POS systems in Colorado. We will successfully implement any POS configuration imaginable for your unique business. As hospitality professionals, we are dedicated to anticipating and exceeding you and your customer’s needs.

Serving the hospitality industry for over 20 years, we are your local one stop shop for all restaurant, bar, quick service and retail point-of-sale POS systems in Colorado. We will successfully implement any POS configuration imaginable for your unique business. As hospitality professionals, we are dedicated to anticipating and exceeding you and your customer’s needs.

We pledge to provide you with the best products, service and price guaranteed.

Our local 365x7x24 support is unmatched in the industry.We install and connect point of sale systems spanning all restaurant segments:

- Quick Service POS System

- Fine Dining POS System

- Bar & Nightclub POS System

- Venue POS System

- Delivery & Takeout POS System

- Hotel & Resort POS System

- Casinos POS System

- Multi Unit establishments POS System

Smart POS will provide the most reliable and easy to use Point of Sale system and credit card processing services at the best price with superior service and support.

Call now to schedule a free demo: 303-309-1218

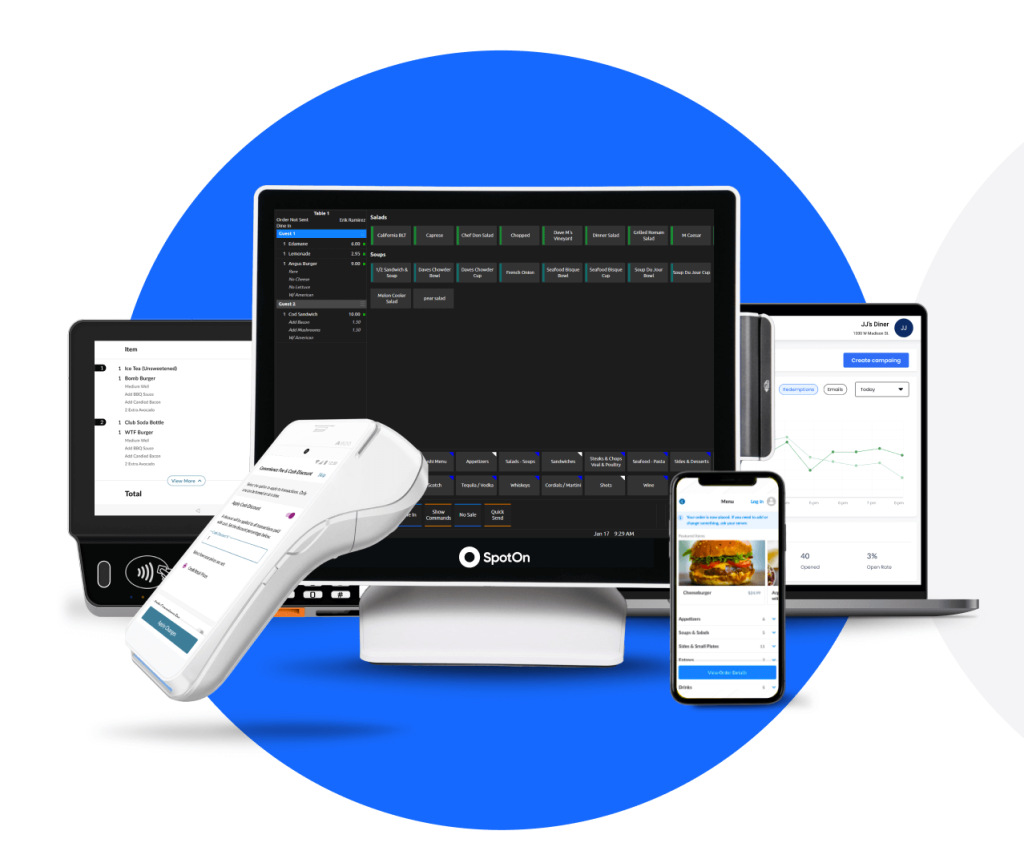

Designed as a turnkey solution that can grow with your business, Smart POS offers everything you need to efficiently and effectively manage your business. Smart POS can provide integrated time and attendance, integrated credit card payments, gift card & loyalty, inventory control, table side ordering & payment, real time alerts, mobile management & a robust back office to help increase revenue, cut costs & boost your bottom line.

Designed as a turnkey solution that can grow with your business, Smart POS offers everything you need to efficiently and effectively manage your business. Smart POS can provide integrated time and attendance, integrated credit card payments, gift card & loyalty, inventory control, table side ordering & payment, real time alerts, mobile management & a robust back office to help increase revenue, cut costs & boost your bottom line.

Smart POS has over 20 years experience meeting and exceeding the needs of customers in all hospitality environments. Bring your business to the next level of efficiency and profitability with Smart POS.

Call us today at 303-309-1218 or email us to schedule a Demo.

Blog Posts are Below:

Category Archives: POS Credit Card Processing Colorado

Credit Card Processing for POS Systems

Credit card processing for POS systems is a major concern when considering which technology to use. Credit cards are a significant source of revenue for restaurants. Despite their widespread adoption, merchant fees are already a burden. Being produced by EVO Payment solutions gives Smarter POS access to 150 currencies in a global market.

Credit card processing for POS systems is a major concern when considering which technology to use. Credit cards are a significant source of revenue for restaurants. Despite their widespread adoption, merchant fees are already a burden. Being produced by EVO Payment solutions gives Smarter POS access to 150 currencies in a global market.

How do credit cards affect my business?

Many small businesses and startups have little leeway for fees. Even so, the average merchant fee among credit card processors is typically between 2 and 3 percent of a sale. Clients generally pay a higher cost when using credit.

Despite the additional cost, accepting credit cards drives sales. A survey by Intuit found that 83 percent of businesses saw an increase in revenue after starting to take credit. Fifty-two percent of companies saw an increase of at least $1000 with 18 percent receiving a boost of $20000 each month.

Not only do credit cards broaden the customer base but they lead to increased spending. For restaurant employees and employers, this means that tips often increase as well. The money in their wallet is not limiting the amount your customer spends.

Some credit card companies allow you to negotiate a fee. Many providers offer tiered accounts with lower costs at higher volumes of sales.

Do I need to purchase additional equipment to accept credit cards?

If your hardware does not provide a point of sales system, you need to purchase additional software. This allows you to take advantage of the efficiencies generated by an electronic payment system.

If your hardware does not provide a point of sales system, you need to purchase additional software. This allows you to take advantage of the efficiencies generated by an electronic payment system.

The Smarter POS system offers integrated credit card payments and a variety of features. Our SecureTablePay, operating in over 2000 restaurants, works with more than 20 of the top restaurant management systems. We work with you to increase efficiency and drive sales with whichever provider you choose.

The efficiencies that our system provide are a benefit to both your servers and your bottom line. Efficiency increases the revenue per person per hour while allowing your waiters to handle more tables. The system also closes a sale from the pinpad, avoiding the potential security issues related to credit card receipts.

Alternative options such as Stripe exist. However, obtaining inventory tracking and the power of a full point of sale system means purchasing additional software.

What are the most commonly accepted credit cards?

Businesses in America face a wide variety of options when considering which credit cards to support. Visa, Mastercard, American Express, and Discover are the largest providers. However, banks such as Chase also offer options to qualified customers.

Businesses in America face a wide variety of options when considering which credit cards to support. Visa, Mastercard, American Express, and Discover are the largest providers. However, banks such as Chase also offer options to qualified customers.

Many of the most popular credit card companies require good to excellent credit for your customer to become a cardholder. Companies are as concerned about being paid back as you. This is particularly true if they charge an extra fee to use their systems.

Point of sales systems may charge a fee to access your merchant account. For example, Stripe includes a 2.9 percent processing fee with an additional charge of 30 cents for a successful transaction. These fees often cover the merchant fee and give you access to any other software required to process a credit card.

Credit card processing for POS systems is common. Smarter POS offers superior quality and the prospect of better efficiency. Contact Svend Bramsoe today to find out how our POS systems can benefit your restaurant.

POS Credit Card Processing Colorado

POS Credit card processing

POS systems in Colorado can be purchased with an integrated credit card processor, or an external machine. You have to consider compatibility and credit card fees as well. Do you choose a processor with integrated capabilities that may only work with one processor, or a stand alone system that operates smoothly with several processors? Here are some benefits and drawbacks to both options.

POS systems in Colorado can be purchased with an integrated credit card processor, or an external machine. You have to consider compatibility and credit card fees as well. Do you choose a processor with integrated capabilities that may only work with one processor, or a stand alone system that operates smoothly with several processors? Here are some benefits and drawbacks to both options.

Integrated credit card processing benefits

Integrated credit card processing allows for you to create a CRM, or customer relationship management system. By integrating your credit card system directly into your POS, owners gather important customer insights that they can use to analyze customer behavior.

Integrated credit card processing and loyalty programs

Integration also gives you the freedom to run unique loyalty programs with your customers. For example, every time a customer swipes their card, they can accumulate points in your loyalty system. This simple measure could improve your adoption rate by 10x. Without even running any specific promotions, you’re gaining and retaining loyal customers with each swipe of their cards.

Integration also gives you the freedom to run unique loyalty programs with your customers. For example, every time a customer swipes their card, they can accumulate points in your loyalty system. This simple measure could improve your adoption rate by 10x. Without even running any specific promotions, you’re gaining and retaining loyal customers with each swipe of their cards.

Integrated loyalty programs also save you money because they don’t need expensive upgrades or in-store training. Exterior loyalty programs always require extensive in-store training, which can be difficult across large scale operations. Integrated systems automatically work their magic with the swipe of a card, requiring very little training and upkeep.

Integrated credit card processing and credit card fees

Integrated credit card processing also allows for transparency with credit card fees. Credit cards may vary in their fees. For example, a corporate credit card and a cash rewards card may acquire different costs. With integration, you can easily see all of the credit card fees that you are paying, which helps to balance the books. Some POS systems even offer flat rates on credit card fees, meaning you’re paying the same fee per swipe no matter the type of card being used. This makes reconciliation easier than ever.

Integrated credit card processing drawbacks

Standalone systems are much cheaper than integrated systems. If you’re a small business just starting out, you’ll want to keep overhead costs down.

Standalone systems are much cheaper than integrated systems. If you’re a small business just starting out, you’ll want to keep overhead costs down.

Another significant issue with integrated credit card processing systems is that the POS system often comes with a pre-selected suite of credit card processors to choose from. Down the line if you want to change credit card processors, you may need to change your entire POS system, which is costly.

While standalone systems offer more freedom of credit card processor choice, they tend to work best with smaller businesses who are just starting out. If you are a larger business that plans to run a loyalty program and wants the ease of smart analytics, choosing an integrated POS system and credit card processor in one unit may be the smarter choice.