Call Today For a Free Demo: 303-309-1218

Email: info@smarterpos.net

The Best POS System Sales, Installation & Support

Welcome to Smart POS Colorado

Serving the hospitality industry for over 20 years, we are your local one stop shop for all restaurant, bar, quick service and retail point-of-sale POS systems in Colorado. We will successfully implement any POS configuration imaginable for your unique business. As hospitality professionals, we are dedicated to anticipating and exceeding you and your customer’s needs.

Serving the hospitality industry for over 20 years, we are your local one stop shop for all restaurant, bar, quick service and retail point-of-sale POS systems in Colorado. We will successfully implement any POS configuration imaginable for your unique business. As hospitality professionals, we are dedicated to anticipating and exceeding you and your customer’s needs.

We pledge to provide you with the best products, service and price guaranteed.

Our local 365x7x24 support is unmatched in the industry.We install and connect point of sale systems spanning all restaurant segments:

- Quick Service POS System

- Fine Dining POS System

- Bar & Nightclub POS System

- Venue POS System

- Delivery & Takeout POS System

- Hotel & Resort POS System

- Casinos POS System

- Multi Unit establishments POS System

Smart POS will provide the most reliable and easy to use Point of Sale system and credit card processing services at the best price with superior service and support.

Call now to schedule a free demo: 303-309-1218

Designed as a turnkey solution that can grow with your business, Smart POS offers everything you need to efficiently and effectively manage your business. Smart POS can provide integrated time and attendance, integrated credit card payments, gift card & loyalty, inventory control, table side ordering & payment, real time alerts, mobile management & a robust back office to help increase revenue, cut costs & boost your bottom line.

Designed as a turnkey solution that can grow with your business, Smart POS offers everything you need to efficiently and effectively manage your business. Smart POS can provide integrated time and attendance, integrated credit card payments, gift card & loyalty, inventory control, table side ordering & payment, real time alerts, mobile management & a robust back office to help increase revenue, cut costs & boost your bottom line.

Smart POS has over 20 years experience meeting and exceeding the needs of customers in all hospitality environments. Bring your business to the next level of efficiency and profitability with Smart POS.

Call us today at 303-309-1218 or email us to schedule a Demo.

Blog Posts are Below:

Squirrel Systems: A Versatile and Customizable POS Solution for the Hospitality Industry

Squirrel Systems POS is a popular and versatile point of sale (POS) solution for the hospitality industry that offers a wide range of features and functionalities. From fine dining restaurants to fast food chains, Squirrel Systems POS is a versatile and customizable POS solution that can help restaurants of all sizes and types streamline their operations and enhance customer experience. In this blog post, we’ll take a closer look at the benefits of choosing Squirrel Systems POS for your restaurant and why Smart POS Inc. is the best choice for your POS system needs.

Squirrel Systems POS is a popular and versatile point of sale (POS) solution for the hospitality industry that offers a wide range of features and functionalities. From fine dining restaurants to fast food chains, Squirrel Systems POS is a versatile and customizable POS solution that can help restaurants of all sizes and types streamline their operations and enhance customer experience. In this blog post, we’ll take a closer look at the benefits of choosing Squirrel Systems POS for your restaurant and why Smart POS Inc. is the best choice for your POS system needs.

Top POS Solution for the Hospitality Industry

Versatility and Customization

Squirrel Systems POS is a versatile and customizable POS solution that can be tailored to meet the unique needs of your restaurant. Whether you’re running a fine dining restaurant, a casual eatery, or a fast food chain, Squirrel Systems POS can be customized to suit your specific requirements. With a wide range of features and functionalities, Squirrel Systems POS can help restaurants of all sizes and types streamline their operations, improve efficiency, and enhance customer experience.

Efficient Order Management

Squirrel Systems POS offers efficient order management functionalities, including tableside ordering and mobile ordering, which can help streamline the order-taking process and reduce wait times for customers. This feature is particularly important for restaurants with a high volume of orders, where speed and efficiency are essential to providing excellent customer service.

Inventory Management

Squirrel Systems POS also offers powerful inventory management features, allowing restaurant owners to easily track inventory levels, set reorder points, and generate inventory reports. This feature helps restaurant owners reduce waste and improve efficiency, ensuring that the restaurant always has the right amount of inventory on hand.

Robust Reporting and Analytics

Another key benefit of using Squirrel Systems POS is its robust reporting and analytics capabilities. This feature allows restaurant owners to track sales, inventory, and other metrics, providing valuable insights into the performance of their business. This information can be used to identify areas for improvement, optimize pricing and menu options, and make data-driven decisions that can help improve the overall customer experience.

Easy Integration with Third-Party Systems

Squirrel Systems POS offers easy integration with a wide range of third-party systems, including payment processors, loyalty programs, and customer relationship management (CRM) systems. This integration allows for greater efficiency and accuracy in managing your restaurant’s operations, providing a more seamless and enjoyable experience for customers.

Why Choose Smart POS?

At Smart POS, we are committed to providing the best installation, support, and maintenance services to help you get the most out of your POS system. We work with you to customize a POS system that meets the specific needs of your restaurant, and we offer comprehensive service and support to ensure that your system is always up and running.

Contact Us Today

At Smart POS, we are dedicated to helping restaurant owners improve their operations and enhance customer experience. Contact us today to learn more about our range of POS systems and services. Let us help you take your restaurant to the next level.

SMART POS

Svend Bramsoe

9962 West Victoria Place #202

Littleton, CO 80127

303-309-1218

info@smarterpos.net

https://www.smarterpos.net/

EVO Payments: A Comprehensive Payment Solution for Quick Service Restaurants

In this blog post, we’ll take a closer look at how EVO Payments POS can benefit your quick service restaurant, and why Smart POS is the best choice for your POS system needs, including credit card & payment processing.

In this blog post, we’ll take a closer look at how EVO Payments POS can benefit your quick service restaurant, and why Smart POS is the best choice for your POS system needs, including credit card & payment processing.

Payment Solution for Quick Service Restaurants

In the quick service restaurant industry, the speed and efficiency of payment processing is crucial to ensuring customer satisfaction and maximizing profits. A reliable point of sale (POS) system with a comprehensive payment solution is essential for quick service restaurants to keep up with the fast-paced environment and provide a seamless experience for customers. EVO Payments POS is a popular and trusted POS system that offers a comprehensive payment solution for quick service restaurants.

Flexible Payment Options

EVO Payments offers flexible payment options for quick service restaurants, making it easy to accept a variety of payment types, including credit and debit cards, mobile payments, and contactless payments. This flexibility allows for a faster and more convenient payment process for customers, improving their overall experience at the restaurant.

Fast and Reliable Payment Processing

EVO Payments is designed to process payments quickly and reliably, reducing wait times and minimizing the chances of payment errors. This feature is particularly important for quick service restaurants, where speed and efficiency are essential to keeping customers happy and satisfied.

Seamless Integration with Other Systems

EVO Payments also offers seamless integration with other systems and software, making it easy to incorporate features like inventory management, employee scheduling, and customer relationship management into your restaurant’s operations. This integration allows for greater efficiency and accuracy in managing your restaurant’s operations, providing a more seamless and enjoyable experience for customers.

Robust Reporting and Analytics

Another key benefit of using EVO Payments is its robust reporting and analytics capabilities. This feature allows restaurant owners to track sales, inventory, and other metrics, providing valuable insights into the performance of their business. This information can be used to identify areas for improvement, optimize pricing and menu options, and make data-driven decisions that can help improve the overall customer experience.

Advanced Security Features

EVO Payments also offers advanced security features, including end-to-end encryption and tokenization, to ensure that customer data is always protected. This feature is essential for quick service restaurants that process a high volume of transactions and must prioritize the security of their customers’ sensitive information.

Why Choose Smart POS?

At Smart POS, we are committed to providing the best installation, support, and maintenance services to help you get the most out of your POS system. We work with you to customize a POS system that meets the specific needs of your quick service restaurant, and we offer comprehensive service and support to ensure that your system is always up and running.

Contact Us Today

At Smart POS, we are dedicated to helping quick service restaurant owners improve their operations and enhance customer experience. Contact us today to learn more about our range of POS systems and services, including EVO Payments, SpotOn, Maitre’d, and Squirrel Systems. Let us help you take your quick service restaurant to the next level.

SMART POS

Svend Bramsoe

9962 West Victoria Place #202

Littleton, CO 80127

303-309-1218

info@smarterpos.net

How Maitre’d POS Can Help Your Restaurant Improve Customer Experience

In this blog post, we’ll take a closer look at how Maitre’d POS can help your restaurant improve customer experience, and why Smart POS is the best choice for your POS system needs. In today’s highly competitive restaurant industry, customer experience is key to building a loyal customer base and staying ahead of the competition. A point of sale (POS) system is an essential tool that can help restaurant owners improve customer experience by streamlining operations and providing a seamless payment process. One of the most popular and reliable POS systems available today is Maitre’d POS.

In this blog post, we’ll take a closer look at how Maitre’d POS can help your restaurant improve customer experience, and why Smart POS is the best choice for your POS system needs. In today’s highly competitive restaurant industry, customer experience is key to building a loyal customer base and staying ahead of the competition. A point of sale (POS) system is an essential tool that can help restaurant owners improve customer experience by streamlining operations and providing a seamless payment process. One of the most popular and reliable POS systems available today is Maitre’d POS.

Streamlined Ordering and Payment Process

One of the most significant benefits of using Maitre’d POS is its streamlined ordering and payment process. With Maitre’d POS, restaurant staff can quickly and easily take orders and process payments, reducing wait times and improving customer satisfaction. The system’s intuitive interface and customizable menu options also allow for easy customization of orders, making it easy to accommodate special requests and dietary restrictions.

Improved Order Accuracy

Maitre’d POS also helps improve order accuracy by eliminating the need for handwritten orders and reducing the chances of miscommunication between staff and kitchen. The system’s easy-to-use interface and customizable order options ensure that orders are always accurate and complete, reducing the likelihood of errors and customer complaints.

Seamless Integration with Other Systems

Maitre’d POS is also designed to integrate seamlessly with other systems and software, making it easy to incorporate features like inventory management, employee scheduling, and customer relationship management into your restaurant’s operations. This integration allows for greater efficiency and accuracy in managing your restaurant’s operations, providing a more seamless and enjoyable experience for customers.

Robust Reporting and Analytics

Another key benefit of using Maitre’d POS is its robust reporting and analytics capabilities. This feature allows restaurant owners to track sales, inventory, and other metrics, providing valuable insights into the performance of their business. This information can be used to identify areas for improvement, optimize pricing and menu options, and make data-driven decisions that can help improve the overall customer experience.

Enhanced Customer Relationship Management

Maitre’d POS also offers advanced customer relationship management (CRM) capabilities, allowing restaurant owners to track customer preferences, order history, and other valuable information. This feature allows restaurant staff to provide personalized recommendations and improve the overall customer experience by tailoring their service to each individual customer’s preferences.

Why Choose Smart POS?

At Smart POS, we are committed to providing the best installation, support, and maintenance services to help you get the most out of your POS system. We work with you to customize a POS system that meets the specific needs of your restaurant, and we offer comprehensive service and support to ensure that your system is always up and running.

Maitre’d POS for Your Restaurant: Contact Us Today

At Smart POS, we are dedicated to helping restaurant owners improve their operations and enhance customer experience. Contact us today to learn more about our range of POS systems and services, including Maitre’d POS, SpotOn, EVO Payments, and Squirrel Systems. Let us help you take your restaurant to the next level.

Contact Information

SMART POS

Svend Bramsoe

9962 West Victoria Place #202

Littleton, CO 80127

303-309-1218

info@smarterpos.net

https://www.smarterpos.net/

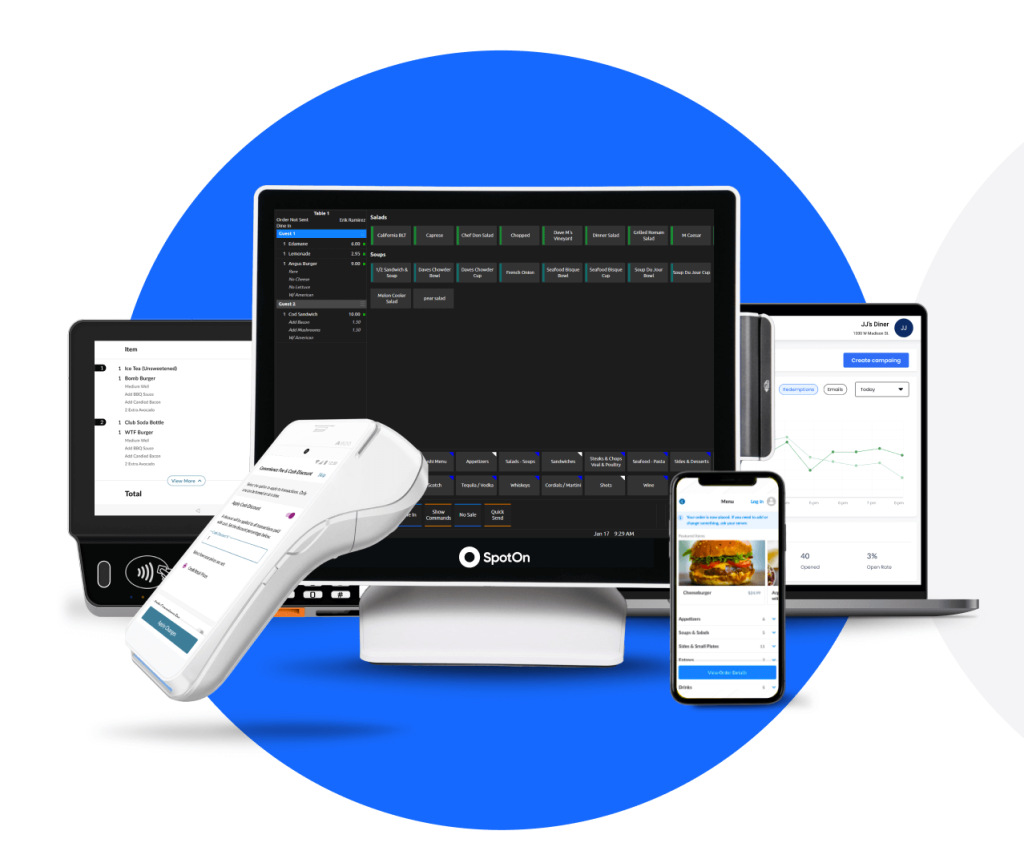

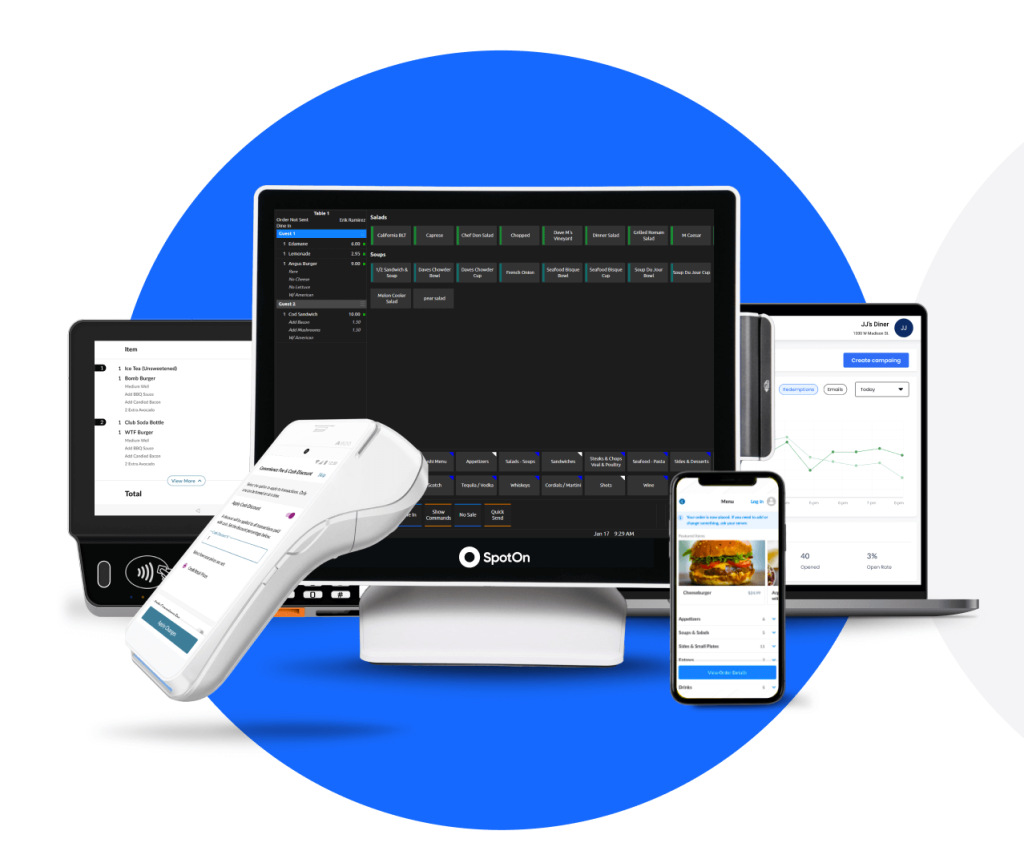

The Benefits of Choosing SpotOn POS for Your Bar or Nightclub

In this blog post, we’ll take a closer look at the benefits of choosing SpotOn POS for your bar or nightclub, and why Smart POS is the best choice for your POS system needs. Running a bar or nightclub can be a challenging task, but having the right tools and technology can make all the difference. One of the most innovative and advanced point of sale (POS) systems available today is SpotOn POS.

Customizable Menu and Ordering

One of the most significant benefits of SpotOn POS is its customizable menu and ordering capabilities. This feature allows bar and nightclub owners to create unique and visually appealing menus that reflect their brand and style. It also allows for easy customization of drinks and food orders, making it easy for staff to quickly and accurately place orders.

Inventory Management

Another key feature of SpotOn POS is its inventory management capabilities. This feature allows bar and nightclub owners to track inventory levels in real-time, ensuring that they always know what items are in stock and when it’s time to reorder. It also helps prevent waste by alerting staff when an item is running low, so they can make sure it is used before it goes bad.

Marketing Tools

SpotOn POS also offers a range of marketing tools to help bar and nightclub owners promote their business and attract new customers. These tools include email marketing, loyalty programs, and social media integration, allowing bar and nightclub owners to reach a wider audience and engage with their customers more effectively.

Reporting and Analytics

SpotOn POS also offers comprehensive reporting and analytics capabilities, providing valuable insights into the performance of your business. This feature allows bar and nightclub owners to track sales, inventory, and other metrics, helping them make informed decisions about their operations and identify areas for improvement.

Easy Integration

SpotOn POS is also designed to integrate seamlessly with other software and hardware, making it easy to customize your POS system to meet the unique needs of your business. This feature allows bar and nightclub owners to incorporate a range of features and functionality into their POS system, from credit card processing to employee management tools.

Why Choose Smart POS?

At Smart POS, we are committed to providing the best installation, support, and maintenance services to help you get the most out of your POS system. We work with you to customize a POS system that meets the specific needs of your bar or nightclub, and we offer comprehensive service and support to ensure that your system is always up and running.

Contact Us Today

At Smart POS, we are committed to helping bar and nightclub owners manage their operations more efficiently, improve customer experience, and grow their business.

Contact us today to learn more about our range of POS systems and services, including SpotOn POS, Maitre’d, EVO Payments, and Squirrel Systems. Let us help you take your business to the next level.

Contact Information

SMART POS

Svend Bramsoe

303-309-1218

info@smarterpos.net

https://www.smarterpos.net/

The Future of Restaurant POS Systems: A Look at the Latest Innovations and Trends

In this blog post, we’ll take a look at the future of restaurant POS systems and how Smart POS can help you stay ahead of the curve. The restaurant industry is constantly evolving, and as technology advances, so do the needs of business owners. The point of sale (POS) system is a vital tool for any restaurant, and it’s important to stay up to date with the latest innovations and trends in order to stay competitive.

The Rise of Mobile POS

One of the biggest trends in restaurant POS systems is the rise of mobile POS. With the use of tablets and other mobile devices, servers can take orders and process payments from anywhere in the restaurant. This not only improves the efficiency of the ordering process, but it also enhances the customer experience. Smart POS offers a variety of mobile POS solutions, including tablet-based systems and mobile payment processing, to help restaurants stay competitive in this rapidly evolving landscape.

The Importance of Data Analytics

Another trend in restaurant POS systems is the increasing importance of data analytics. By collecting and analyzing data on customer orders, menu items, and sales trends, restaurants can make more informed decisions about their business. Smart POS offers advanced reporting and analytics tools that can help restaurant owners identify areas for improvement, optimize their menu offerings, and better understand their customers’ preferences.

The Integration of AI and Machine Learning

The Integration of AI and Machine Learning

Artificial intelligence (AI) and machine learning are rapidly transforming the restaurant industry, and POS systems are no exception. With the use of AI-powered tools, restaurants can automate many of their processes, such as menu management and inventory tracking, and improve their overall efficiency. Smart POS offers a variety of AI-powered tools and integrations, including automated inventory management and predictive ordering, to help restaurants stay ahead of the curve.

The Importance of Contactless Payment Processing

In the wake of the COVID-19 pandemic, contactless payment processing has become more important than ever before. Customers are looking for ways to minimize their physical contact with surfaces, and restaurants that offer contactless payment options are more likely to attract and retain customers. Smart POS offers a variety of contactless payment processing solutions, including mobile payment processing and NFC-enabled card readers, to help restaurants meet the needs of their customers and keep them safe.

The Need for Customization and Flexibility

Finally, it’s important to recognize the need for customization and flexibility in restaurant POS systems. Every restaurant is unique, and what works for one may not work for another. Smart POS offers a variety of customizable solutions and flexible pricing plans to help restaurants find the system that works best for their specific needs and budget.

Future of Restaurant POS Systems: Conclusion

In conclusion, the future of restaurant POS systems is rapidly evolving, and it’s important to stay ahead of the curve in order to remain competitive. By embracing the latest trends and innovations, such as mobile POS, data analytics, AI and machine learning, contactless payment processing, and customization and flexibility, restaurants can improve their efficiency, enhance the customer experience, and ultimately grow their business. Smart POS Inc. is committed to helping restaurants achieve these goals with our comprehensive POS system installation, credit card processing services, POS hardware, and service and support.

Looking for a comprehensive POS system for your restaurant? Contact Smart POS today to learn more about our industry-leading solutions, including SpotOn, Maitre’d, EVO Payments, and Squirrel Systems. With our expertise in POS system installation, credit card processing services, POS hardware, and service and support, we can help take your business to the next level.

Contact us today to learn more about how we can help you stay ahead of the curve in the ever-evolving restaurant industry.

SMART POS

Svend Bramsoe

303-309-1218

info@smarterpos.net

Smart POS Service and Support: Keeping Your Business Running Smoothly

Smart POS is a Colorado based company that specializes in providing point of sale (POS) system installation, POS credit card processing services, and POS hardware, service, and support. One of the key benefits of partnering with Smart POS is the exceptional service and support that they provide to their clients. In this blog post, we will explore the importance of service and support when it comes to POS systems and how Smart POS can help keep your business running smoothly.

The Importance of Service and Support for POS Systems

POS systems are critical to the success of any restaurant or business in the hospitality industry. They allow for seamless transactions, inventory management, and the ability to provide excellent customer service. However, when something goes wrong with your POS system, it can be a nightmare for your business. That’s where service and support come in. Having access to expert support can help minimize downtime and ensure that any issues are resolved quickly and efficiently.

Smart POS Service and Support

Smart POS understands the importance of service and support when it comes to POS systems. The owner Svend Bramsoe is a highly experienced point of sale expert and is available 24/7 to provide support to clients. Here are some of the ways that Smart POS can help keep your business running smoothly:

24/7 Support

24/7 Support

Smart POS offers 24/7 support to their clients. This means that you can get help whenever you need it, whether it’s in the middle of the night or on a holiday weekend. They understand that downtime can be costly for your business, and they strive to minimize it as much as possible.

On-Site Support

In addition to remote support, Smart POS also offers on-site support to clients. If a technician needs to come to your location to resolve an issue, Smart POS will send someone out as quickly as possible. This helps ensure that any issues are resolved quickly, and your business can get back to normal operations.

Hardware Replacement

If your POS hardware fails, Smart POS can quickly replace it to minimize downtime. They have a wide range of hardware options available, so you can be sure that you’re getting the right equipment for your needs.

Training and Education

Smart POS understands that the success of your business depends on your ability to use your POS system effectively. That’s why they offer training and education to their clients. They can provide you with the tools and knowledge you need to get the most out of your POS system and ensure that your staff is well-trained in its use.

Smart POS Service and Support: Conclusion

Service and support are critical when it comes to POS systems. Smart POS understands this and goes above and beyond to ensure that their clients have access to the support they need to keep their businesses running smoothly. With 24/7 support, on-site support, hardware replacement, and training, Smart POS is the ideal partner for any business in the hospitality industry.

Are you looking for a reliable partner to provide you with POS systems and services for your business? Contact us today to learn more about our POS systems and services for the hospitality industry. We look forward to helping your business thrive.

SMART POS

Svend Bramsoe

303-309-1218

info@smarterpos.net

Choosing the Right POS Hardware for Your Restaurant: A Guide from Smart POS

As a business owner, choosing the right POS hardware for your restaurant is a crucial decision that can impact your business’s success. With so many options available, it can be overwhelming to decide which one is the best fit for your restaurant. That’s where Smart POS Inc. comes in. As a Colorado-based POS system reseller, we specialize in providing installation, credit card processing services, hardware, and ongoing support to help you streamline your restaurant’s operations. In this blog post, we’ll guide you through the process of choosing the right POS hardware for your restaurant.

Consider Your Restaurant’s Specific Needs

The first step in choosing the right POS hardware for your restaurant is to consider your specific needs. For example, if you run a busy fast-casual restaurant, you may need a POS system that can handle a high volume of transactions quickly. On the other hand, if you run a fine dining establishment, you may prioritize a system that can handle multiple courses and complex orders.

Look for Hardware That Integrates with Your POS Software

Once you’ve determined your restaurant’s needs, it’s important to look for hardware that can integrate with your POS software. This ensures that your POS system runs smoothly and reduces the risk of technical issues. At Smart POS Inc in Colorado, POS expert Svend Bramsoe offers a range of hardware options that integrate with popular POS software such as SpotOn, Maitre’d, EVO Payments, and Squirrel Systems.

Consider the Cost

Cost is always a factor when it comes to choosing POS hardware for your restaurant. However, it’s important to remember that the cheapest option may not always be the best. Cheaper hardware may not be as reliable or may not integrate as seamlessly with your POS software. When you invest in high-quality POS hardware, you’re making an investment in your restaurant’s success.

Look for Hardware with Ongoing Support

Even with the best hardware and software, technical issues can arise. That’s why it’s important to choose hardware with ongoing support. At Smart POS, we offer ongoing support for all of our hardware to ensure that your system runs smoothly at all times. This includes both remote and on-site support as needed.

Choose a Provider with Experience and Expertise

Finally, when choosing POS hardware for your restaurant, it’s important to choose a provider with experience and expertise in the industry. At Smart POS, we have years of experience working with restaurants of all sizes and types. We understand the unique needs of the industry and can provide expert guidance to help you choose the right hardware for your specific needs.

POS Hardware for Your Restaurant: Choose Smart POS Inc. in Colorado

In conclusion, choosing the right POS hardware for your restaurant is a crucial decision that can impact your business’s success. By considering your specific needs, looking for hardware that integrates with your POS software, considering the cost, looking for hardware with ongoing support, and choosing a provider with experience and expertise, you can make an informed decision that sets your restaurant up for success.

If you’re looking for POS systems and services for the hospitality industry, contact Svend at Smart POS today!

Contact Smart POS

SMART POS

Svend Bramsoe

303-309-1218

info@smarterpos.net

https://www.smarterpos.net/

5 Reasons Why Smart POS Inc. is the Best POS System for Restaurant Owners

In this blog post, we’ll take a look at five reasons why Smart POS Inc is the best POS system for restaurant owners. Running a restaurant can be a challenging task, but having the right tools and technology can make all the difference. That’s where Smart POS comes in. We specialize in providing point of sale (POS) systems and services to restaurant owners, helping them streamline their operations, manage transactions, and improve their bottom line.

In this blog post, we’ll take a look at five reasons why Smart POS Inc is the best POS system for restaurant owners. Running a restaurant can be a challenging task, but having the right tools and technology can make all the difference. That’s where Smart POS comes in. We specialize in providing point of sale (POS) systems and services to restaurant owners, helping them streamline their operations, manage transactions, and improve their bottom line.

5 Reasons Why Smart POS Inc. is the Best POS System for Restaurant Owners

1. Expertise

At Smart POS, we have years of experience in the hospitality industry, and we understand the unique needs of restaurant owners. We work with you to customize a POS system that meets the specific needs of your business, and we provide expert advice and support every step of the way. Our team of professionals is dedicated to ensuring that your business runs smoothly and efficiently.

2. Comprehensive Services

We offer a range of services to help restaurant owners manage their operations more efficiently, from installation and training to ongoing support and maintenance. We also offer credit card processing solutions to help you manage transactions quickly and easily. Our comprehensive services ensure that your POS system is up and running smoothly, so you can focus on what matters most: your customers.

3. Cutting-Edge Technology

At Smart POS, we are committed to staying on the cutting edge of technology. We offer a range of POS systems and hardware options to meet the unique needs of your business, including traditional cash registers, touchscreen terminals, and mobile POS systems. We also offer cloud-based POS systems, which provide real-time access to data and analytics, allowing you to make informed decisions about your business.

4. Reliability

Downtime is not an option for restaurant owners, which is why we are committed to providing reliable and efficient POS systems and services. Our team is available 24/7 to help you troubleshoot any issues and ensure that your business is always operating at peak efficiency. We also offer backup systems and redundancy options to ensure that your business is always up and running.

5. Cost-Effective Solutions

At Smart POS, we understand that every business has unique budgetary constraints. That’s why we offer cost-effective POS systems and services to help restaurant owners manage their operations more efficiently without breaking the bank. We work with you to find the right solution that meets your needs and your budget, so you can focus on growing your business.

Best POS System for Restaurant Owners: Contact Us Today

At Smart POS Inc, Svend Bramsoe is committed to helping restaurant owners manage their operations more efficiently, improve customer experience, and grow their business.

Contact us today to learn more about our range of POS systems and services, including installation, credit card processing, hardware, service, and support. Let us help you take your restaurant to the next level.

Contact Information

SMART POS

Svend Bramsoe

303-309-1218

info@smarterpos.net

https://www.smarterpos.net/

EVO Payments Inc: Credit Card Processing in the Hospitality Industry

In this blog post, we’ll take a closer look at credit card processing in the hospitality industry, and how EVO Payments Inc. can benefit small businesses. Credit card processing is a crucial aspect of any business, especially in the hospitality industry where customers expect to be able to pay with their credit cards. One of the most popular credit card processing solutions for small businesses in the hospitality industry is EVO Payments Inc.

Credit Card Processing in the Hospitality Industry

What is EVO Payments Inc.?

EVO Payments Inc. is a leading credit card processing company that offers a range of solutions for small businesses in the hospitality industry. It is known for its fast and secure payment processing, which helps businesses increase revenue and improve customer satisfaction.

Fast and Secure Transactions

One of the most significant benefits of using EVO Payments Inc. for credit card processing is the speed and security of its transactions. EVO Payments Inc. uses the latest encryption and tokenization technologies to ensure that all transactions are safe and secure. It also offers fast authorization times, which means that customers can complete transactions quickly and easily.

Flexible Payment Options

EVO Payments Inc. offers a range of payment options to help small businesses in the hospitality industry meet the needs of their customers. It allows businesses to accept all major credit and debit cards, as well as contactless payments, such as Apple Pay and Google Wallet. This helps businesses accommodate customers who prefer to pay with their mobile devices, which is becoming increasingly common.

Integration with POS Systems

EVO Payments Inc. integrates seamlessly with many of the leading POS systems used in the hospitality industry, including SpotOn, Maitre’d, EVO Payments, and Squirrel Systems. This makes it easy for small business owners to manage their transactions and track sales, inventory, and other important metrics.

How Smart POS Can Help Your Small Business

At Smart POS, we understand the unique needs of small businesses in the hospitality industry. That’s why we work with you to customize a credit card processing solution that meets the specific needs of your business. We offer comprehensive installation and support services to ensure that your system is up and running smoothly from day one.

Hardware and Software

We offer a range of hardware and software options to ensure that your credit card processing system is tailored to your needs. Our hardware options include everything from traditional cash registers to touchscreen terminals, and we can help you choose the best option for your business.

CC Processing

We also offer comprehensive CC processing services to help you manage transactions quickly and easily. Our CC processing solutions integrate seamlessly with EVO Payments Inc., allowing you to accept payments in a variety of ways, including contactless payments.

Service and Support

At Smart POS, we know that downtime is not an option. That’s why we offer comprehensive service and support to ensure that your system is always up and running. Our team is available 24/7 to help you troubleshoot any issues and ensure that your business is always operating at peak efficiency.

Credit Card Processing in the Hospitality Industry: Conclusion

In conclusion, small businesses in the hospitality industry require a reliable and efficient credit card processing system that can manage transactions and help streamline operations. EVO Payments Inc. is one of the most popular credit card processing solutions for small businesses in the hospitality industry, and it offers a range of features that help small business owners manage their businesses more efficiently.

At Smart POS Inc, we are committed to providing the best installation, support, and maintenance services to help you get the most out of your credit card processing system. Contact us today to learn more about our range of credit card processing solutions and POS systems and services, including EVO Payments, SpotOn, Maitre’d, and Squirrel Systems.

SMART POS

Svend Bramsoe

5201 S Fox St

Littleton, CO 80120

303-309-1218

info@smarterpos.net

https://www.smarterpos.net/lets-talk/

Maitre’d POS: The Best POS Solution for Fine Dining Restaurants

What is the best POS solution for Fine dining restaurants? Restaurants require the best POS system that can manage complex menus, handle multiple courses, and provide excellent customer service. That’s why Smart POS recommends Maitre’d POS, a comprehensive point of sale system designed specifically for fine dining establishments. In this blog post, we’ll take a closer look at Maitre’d POS and how it can benefit your fine dining restaurant.

What is the best POS solution for Fine dining restaurants? Restaurants require the best POS system that can manage complex menus, handle multiple courses, and provide excellent customer service. That’s why Smart POS recommends Maitre’d POS, a comprehensive point of sale system designed specifically for fine dining establishments. In this blog post, we’ll take a closer look at Maitre’d POS and how it can benefit your fine dining restaurant.

Best POS Solution for Fine Dining Restaurants: What is Maitre’d POS?

Maitre’d POS is a leading point of sale system designed specifically for fine dining establishments. It offers a range of features that can help fine dining restaurants streamline their operations, improve customer service, and manage costs.

Menu Management

One of the most significant benefits of using Maitre’d POS is its menu management capabilities. With this feature, restaurant owners can easily create and modify menus to reflect seasonal changes or specials. This allows for greater flexibility and helps ensure that customers always have access to the most up-to-date offerings.

Table Management

Another key feature of Maitre’d POS is its table management capabilities. This feature allows restaurant owners to manage table layouts and reservations more efficiently, ensuring that guests are seated promptly and that tables are utilized effectively. It also allows for a seamless experience for customers, as servers can quickly and easily transfer checks between tables or split checks between diners.

Order Management

Maitre’d POS also offers comprehensive order management capabilities. It can handle complex orders and multiple courses, allowing servers to easily manage customer requests and ensure that each course is delivered promptly. This feature ensures that diners have a positive experience and can enjoy their meals without delays.

How Smart POS Can Help Your Restaurant

At Smart POS, we understand the unique needs of fine dining restaurants. That’s why we work with you to customize a POS system that meets the specific needs of your business. We offer comprehensive installation and support services to ensure that your system is up and running smoothly from day one.

Hardware and Software

We offer a range of POS hardware and software options to ensure that your POS system is tailored to your needs. Our hardware options include everything from traditional cash registers to touchscreen terminals, and we can help you choose the best option for your business.

CC Processing

We also offer CC processing services to help you manage transactions quickly and easily. Our CC processing solutions integrate seamlessly with Maitre’d POS, allowing you to accept payments in a variety of ways, including contactless payments.

Service and Support

At Smart POS, we know that downtime is not an option. That’s why we offer comprehensive service and support to ensure that your system is always up and running. Our team is available 24/7 to help you troubleshoot any issues and ensure that your business is always operating at peak efficiency.

Best POS Solution for Fine Dining Restaurants: Conclusion

Maitre’d POS is an excellent choice for fine dining restaurant owners looking to streamline their operations and improve customer experience. At Smart POS, we are committed to providing the best installation, support, and maintenance services to help you get the most out of your POS system.

Contact Svend Bramsoe at Smart POS Inc. in Colorado today to learn more about a range of the best POS systems and services, including Maitre’d, SpotOn, WorldPay, and Squirrel Systems.

SMART POS INC.

Svend Bramsoe

5201 S Fox St, Littleton, CO 80120

303-309-1218

info@smarterpos.net